Introduction

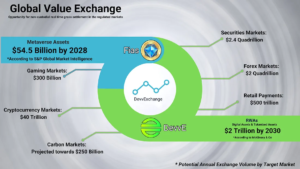

The rapid growth of digital assets—from cryptocurrencies to tokenized real-world assets (RWAs)—has exposed critical gaps in liquidity, payment efficiency, and security. Traditional financial systems struggle to adapt, while decentralized finance (DeFi) solutions often prioritize innovation over stability. Enter DevvISE, a patented liquidity provisioning and payment system powering DevvExchange, designed to bridge these divides. By combining institutional-grade security, regulatory compliance, and decentralized principles, DevvISE redefines how markets handle liquidity, payments, and asset management. This article explores its groundbreaking architecture, real-world applications, and potential to reshape the future of finance.

The Liquidity Crisis in Modern Markets

Liquidity is the lifeblood of financial markets, ensuring assets can be traded quickly without drastic price changes. However, as tokenization expands into real estate, commodities, and intellectual property, exchanges face unprecedented challenges:

- Fragmented Liquidity: Assets are siloed across platforms, forcing traders to juggle multiple exchanges.

- Volatility Spikes: Thin order books lead to erratic price swings, deterring institutional participation.

- Inefficient Solutions:

- Automated Market Makers (AMMs): Plagued by impermanent loss and capital inefficiency.

- Centralized Market Makers: Prone to monopolistic behavior and liquidity withdrawal during crises.

These issues are compounded in digital payments, where volatility, slow settlement, and regulatory ambiguity hinder adoption. A merchant accepting Bitcoin risks revenue erosion from price swings, while users face friction converting tokens across chains.

DevvISE: A Unified Solution for Liquidity, Payments, and Lending

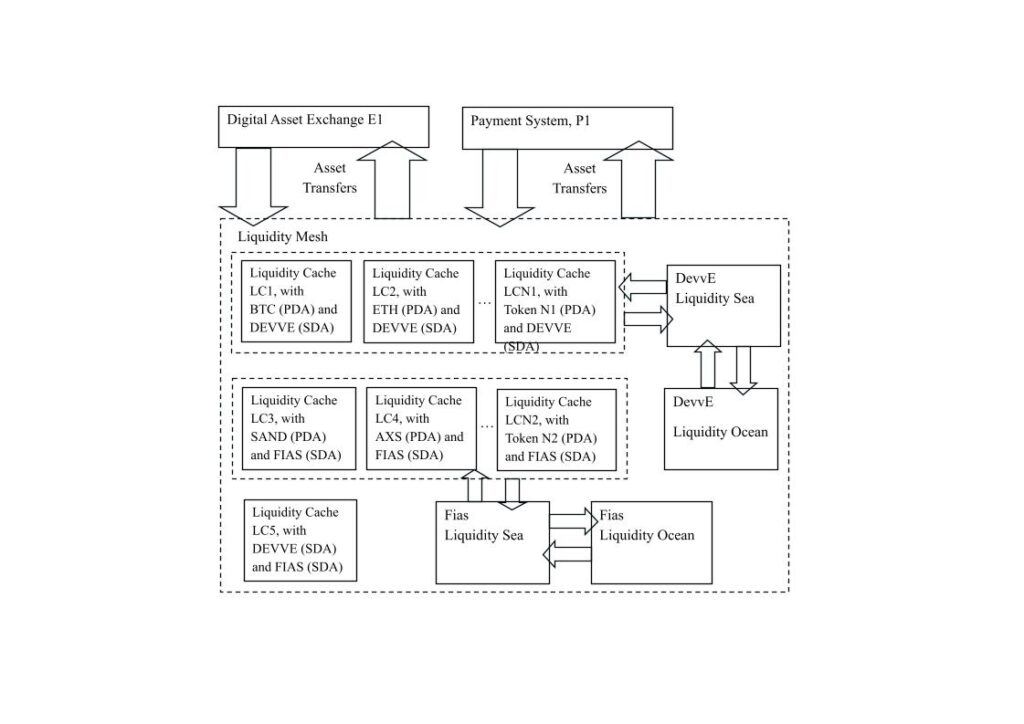

DevvISE addresses these challenges through Liquidity Caches (LCs)—dynamic pools where users contribute assets to power three core functions:

1. Market Making: Stabilizing Markets Through Decentralized Liquidity

How It Works:

- Primary Digital Assets (PDAs): Users deposit high-liquidity assets like Bitcoin or Ethereum into LCs.

- Revenue Generation: PDAs fund market-making activities on DevvExchange, with contributors earning a share of spreads and fees.

- Impact: Deepens order books, tightens bid-ask spreads, and reduces slippage for traders.

Example:

A Liquidity Cache with $10M in Bitcoin could provide continuous buy/sell orders on DevvExchange, ensuring stable pricing even during volatile periods. Contributors earn proportional rewards based on their stake.

2. Instant Payments: Bridging Assets in Real Time

The Problem: Converting Bitcoin to a stablecoin for payments often involves multiple exchanges, delays, and fees.

The DevvISE Solution:

- Shared Digital Assets (SDAs): Tokens like DevvE and FIAS act as intermediaries.

- Contingent Transaction Sets (CTS): Atomic swaps enable cross-asset conversions in milliseconds.

Case Study: Buying Coffee with Bitcoin

- A user scans a QR code to pay $5 in Bitcoin.

- DevvISE triggers a CTS:

- Step 1: Convert Bitcoin → DevvE (via Bitcoin/DevvE LC).

- Step 2: Convert DevvE → USD stablecoin (via DevvE/Stablecoin LC).

- Step 3: Send USD to the merchant.

- All three transactions settle simultaneously, eliminating counterparty risk.

Advantages:

- No Pre-Custody: Assets remain in the user’s wallet until settlement.

- Zero Slippage: Fixed conversion rates via CTS.

3. Risk-Free Lending: Reinventing Collateral Management

Traditional DeFi Pitfalls:

- Smart Contract Risks: Vulnerabilities in protocols like Compound or Aave.

- Tax Complexity: Transferring assets to lending pools triggers taxable events.

DevvISE Innovation:

- Consensus-Level Contracts: Loans are managed at the blockchain’s core, not via smart contracts.

- Collateral Security: Borrowers retain custody; collateral is locked in their wallets until repayment.

- Default Handling: Automated liquidation via CTS ensures lenders recover funds instantly.

Example:

Alice lends 10 ETH from an LC, locking 15 ETH as collateral. If ETH’s price drops, DevvISE liquidates her position atomically, returning funds to lenders without third-party intervention.

The Architecture of Trust: Security, Compliance, and Control

DevvISE’s design prioritizes user security and regulatory alignment—a first in decentralized systems.

1. Non-Custodial Ownership

- Philosophy: “Not your keys, not your crypto” remains sacrosanct.

- Implementation: Users trade, lend, or pay without transferring assets to centralized wallets.

2. Loss and Theft Protections

- Private Key Recovery: Multi-signature protocols allow asset recovery via trusted partners.

- Theft Mitigation: Real-time monitoring and consensus-level locks prevent unauthorized withdrawals.

3. Regulatory Compliance

- Bailment Solutions: Wrapped assets (e.g., tokenized gold) are held by regulated custodians, ensuring legal recourse.

- KYC/AML Integration: Liquidity Cache contributors are verified, aligning with global standards.

4. Privacy Without Compromise

- Selective Transparency: Transaction details are auditable for compliance but anonymized for public ledgers.

Liquidity Seas: Optimizing Returns Across Ecosystems

The Challenge: Individual LCs risk imbalance if demand skews toward specific assets.

The Solution:

- Liquidity Seas: Aggregate SDAs (DevvE, FIAS) across multiple LCs to maintain equilibrium.

- Dynamic Rebalancing: Algorithms adjust asset allocations to meet market demand, minimizing impermanent loss.

Example:

A surge in Bitcoin-to-stablecoin conversions drains a DevvE LC. Liquidity Seas automatically redistribute DevvE from underutilized pools, ensuring continuous liquidity.

DevvISE in Action: Use Cases Across Industries

1. Institutional Finance

- Tokenized Bonds: Pension funds use LCs to trade tokenized Treasuries with T+0 settlement.

- Cross-Border Payments: Corporations convert local currencies to stablecoins instantly, slashing FX fees.

2. Gaming and Metaverse

- NFT Marketplaces: Players borrow FIAS against rare NFTs to fund in-game purchases.

- Play-to-Earn Economies: Earnings in FIAS are instantly convertible to fiat via CTS.

3. Sustainable Finance

- Carbon Credit Trading: Enterprises tokenize credits on DevvX, with LCs ensuring 24/7 liquidity.

The Future of Finance: Bridging DeFi and TradFi

DevvISE’s hybrid model resolves the stalemate between innovation and regulation:

- For TradFi Institutions:

- Regulatory Assurance: Compliance-ready infrastructure for RWAs and stablecoins.

- Yield Opportunities: Earn returns via LCs without smart contract exposure.

- For DeFi Innovators:

- Enhanced Security: Consensus-level protections reduce hacking risks.

- Mainstream Adoption: Fiat gateways and instant payments attract retail users.

- For Governments:

- Transparent Audits: Real-time monitoring of carbon markets or municipal bonds.

Conclusion: A New Paradigm for Digital Assets

DevvISE isn’t merely an upgrade to existing systems—it’s a reimagining of how liquidity, payments, and ownership intersect in a tokenized world. By eliminating custodial risks, democratizing market-making, and enabling instant cross-asset conversions, it positions DevvExchange as the first platform capable of serving both crypto-native traders and institutional investors. As tokenization reshapes global finance, DevvISE’s blend of security, efficiency, and compliance offers a blueprint for the future—one where innovation thrives without sacrificing stability.