DevvDigital Has, For the First Time, Solved Blockchain’s Security Flaws

Understanding Blockchain’s Inherent Security Challenges

The blockchain ecosystem presents persistent security challenges that have hindered mainstream adoption. Private key management represents perhaps the most significant vulnerability in the blockchain security model. Unlike conventional financial systems with recovery mechanisms, private keys create a critical single point of failure—lose your key and permanently forfeit your assets, with no recourse available. Conversely, compromised keys through various attack vectors lead to immediate asset theft.

Even with robust key management, vulnerabilities persist. The recent Bybit incident demonstrated this starkly, with attackers extracting $1.5 billion in digital assets despite sophisticated security measures. This creates an unavoidable security dilemma: strengthening protections against theft typically increases loss risk and complicates recovery, while enhancing accessibility inevitably creates additional attack surfaces for hackers and social engineers. Blockchain participants must navigate this complex balance through hardware security devices, multi-signature protocols, and comprehensive backup systems—yet must ultimately accept that every private key management approach involves fundamental trade-offs between theft protection and loss prevention.

The risk landscape extends far beyond key management. Custodial platforms introduce substantial vulnerabilities—exchange hacks (Bybit, Mt. Gox), financial insolvency (Genesis, BlockFi), or outright fraudulent behavior (FTX, Celsius) have all resulted in catastrophic user losses. Smart contract vulnerabilities and cross-chain bridging exploits have similarly facilitated billions in asset theft. Physical security threats, including ransomware attacks and direct coercion, have forced users to surrender assets under duress.

Operational risks compound these security concerns. Transaction misdirection to incorrect or non-existent addresses results in permanent asset loss due to blockchain’s immutability. Market manipulation techniques like front-running allow malicious actors to extract value from legitimate transactions. Sophisticated phishing operations and counterfeit interfaces trick users into authorizing irreversible transfers. Privacy limitations create additional concerns—blockchain’s transparent nature means transaction participants can be identified, creating unacceptable exposure for institutional participants. Without centralized safeguards, blockchain’s decentralized architecture requires extraordinary vigilance, yet even the most security-conscious users remain vulnerable to emerging threats.

The annual loss of billions in digital assets renders these risks fundamentally unacceptable to traditional financial institutions. DevvDigital delivers a comprehensive solution addressing all the aforementioned vulnerabilities.

Reimagining Blockchain Security Fundamentals

The blockchain community has largely accepted these challenges as inevitable consequences of the technology. Many assume cryptographic key architecture inherently means accepting theft and loss as unavoidable risks, that blockchain’s public ledger precludes meaningful privacy, and that intermediaries remain necessary for asset exchange. This acceptance is fundamentally misguided. Traditional financial incorporation of blockchain technology demands resolving these core issues. DevvDigital has fundamentally redesigned blockchain architecture to address these challenges:

Loss Protection: For the first time, users have remediation options for private key loss without requiring trust in external parties. Combined with theft protection, this creates an unprecedented security layer that transcends traditional key management limitations.

Theft Protection: DevvDigital enables users to define customized asset usage parameters, preventing unauthorized transactions even when keys are compromised. This nullifies both technological and physical coercion attacks. The combined loss and theft protection mechanisms create a security model that no longer relies exclusively on private key security.

Non-Custodial Swaps: Our proprietary Contingent Transaction Set (CTS) technology enables direct peer-to-peer asset exchange without intermediaries, settlement delays, or counterparty risk. This transformative approach eliminates omnibus wallet requirements, restores direct user control, prevents various manipulation tactics, and insulates users from exchange insolvency or misconduct.

Privacy: Our globally patented privacy solution delivers regulatory-compliant confidentiality—addressing a critical institutional requirement for blockchain adoption.

Bailment: DevvDigital’s wrapped token implementation uses a revolutionary approach that completely removes our organization from the custody process. This ensures complete user asset protection even in the unlikely event of organizational insolvency.

Fraud Protection: Our platform enables built-in transaction escrow capabilities, providing remediation pathways for non-delivery scenarios or incorrect address inputs.

These innovations collectively preserve the core blockchain principle of self-custody while introducing unprecedented flexibility through customizable security features unavailable elsewhere in the crypto ecosystem. Users can now configure wallets that provide recourse for blockchain’s most significant security vulnerabilities.

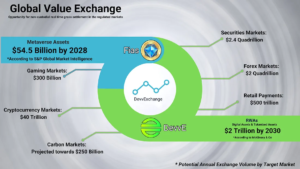

This breakthrough finally provides traditional financial entities with a comprehensive solution for themselves and their customers, enabling full embrace of blockchain technology and real-world asset tokenization without compromising security or regulatory compliance.