March 14, 2025 — DevvDigital™, a trailblazer in blockchain-powered financial solutions, has announced a historic collaboration with a top-tier global financial institution to launch DevvExchange™, the world’s first institutional-grade, non-custodial digital asset exchange featuring mathematically instantaneous settlement (MIS). This partnership, finalized in late 2024, bridges the gap between traditional finance (TradFi) and decentralized digital asset trading, eliminating counterparty risk and redefining security standards for institutions.

A Quantum Leap for Institutional Digital Asset Trading

For decades, TradFi institutions have hesitated to adopt digital assets due to unresolved risks: custodial failures, regulatory ambiguity, and vulnerabilities exposed by collapses like FTX and Mt. Gox. DevvExchange™ shatters these barriers by integrating the DevvX™ blockchain with the infrastructure of a globally recognized financial partner. The result? A platform where transactions settle at T+0 speed (instantaneously) without relying on intermediaries or centralized custody.

Tom Anderson, Chief Strategy Officer of DevvExchange and CEO of Devvio Inc, emphasizes the significance:

“This partnership isn’t just a milestone—it’s a paradigm shift. For the first time, a blockchain exchange guarantees order settlement the moment trades match, combining TradFi reliability with decentralized innovation. This is the gold standard for institutional digital asset trading.”

Solving TradFi’s Biggest Blockchain Hurdles

Traditional financial institutions face five core challenges in adopting digital assets:

- Custody Risks: Loss of private keys or reliance on unregulated third parties.

- Counterparty Failures: Exposure to exchange insolvencies.

- Settlement Delays: T+1/T+2 cycles incompatible with modern markets.

- Regulatory Gaps: Lack of compliance-ready frameworks.

- Scalability Limits: High costs and low throughput.

DevvExchange™ addresses each through groundbreaking innovations:

1. Non-Custodial Architecture

Assets remain under user control via private keys, eliminating omnibus wallets and custodial middlemen. Unlike centralized exchanges, DevvExchange™ cannot access or lose user funds—a critical safeguard against another “FTX-style” collapse.

2. Contingent Transaction Sets (CTS)

CTS technology groups transactions into atomic sets, ensuring they either all succeed or fail simultaneously. This prevents partial settlements and guarantees zero counterparty risk, even during high volatility.

3. Mathematically Instantaneous Settlement (MIS)

Powered by DevvX’s 8M+ TPS blockchain, trades finalize in milliseconds. MIS erases traditional settlement cycles, enabling real-time liquidity and reducing operational costs by up to 70%.

4. Regulatory Compliance by Design

DevvExchange™ embeds KYC/AML protocols and partners with regulated “bailment entities” to custody wrapped assets (e.g., tokenized stocks, bonds). These partners maintain real-time blockchain copies, allowing direct asset recovery even if DevvDigital faces insolvency.

5. Enterprise-Grade Security

A multi-layered security framework includes:

- Validator-Level Protections: Decentralized node consensus.

- Key Recovery Solutions: Mathematical safeguards for lost keys (no trusted third parties).

- Fraud Detection: AI-driven anomaly monitoring.

Why This Partnership Changes Everything

The unnamed financial institution (to be revealed post-regulatory approval) brings decades of market infrastructure expertise, while DevvDigital contributes its patented blockchain tech. Together, they enable:

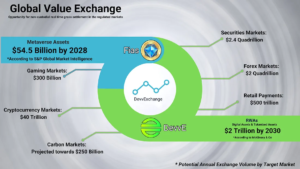

- Institutional Adoption: Banks, hedge funds, and asset managers can now offer digital asset services without regulatory or operational risks.

- Hybrid Asset Trading: Seamless integration of cryptocurrencies, tokenized real-world assets (RWAs), and traditional securities on one platform.

- Global Liquidity Pools: Cross-border trading with compliance baked into every transaction.

Ray Quintana, CEO of DevvDigital, explains:

“We’ve checked every box TradFi requires—security, scalability, compliance, and cost. This isn’t just a crypto exchange; it’s a bridge to the future of finance.”

DevvExchange™ Features at a Glance

- Non-Custodial Trading

- Users retain full asset control; no deposits into exchange wallets.

- T+0 Settlement

- Instant settlement via MIS, eliminating capital lock-up periods.

- Regulated Bailment Partners

- Wrapped assets backed by audited, licensed institutions.

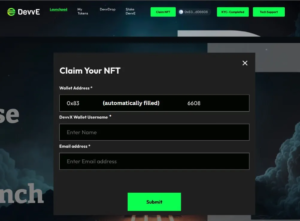

- DevvE™ Integration

- The DevvE token (DEVVE) powers liquidity, staking, and fee discounts.

- Institutional Tools

- APIs for algorithmic trading, dark pools, and OTC desks.

The Roadmap: Launch Timeline and What’s Next

Pending final regulatory approvals, DevvExchange™ will roll out in phases:

- Q2 2025: Partner announcement and beta testing with select institutions.

- Q3 2025: Public launch of spot trading for major cryptocurrencies (BTC, ETH, DEVVE) and tokenized U.S. Treasuries.

- Q4 2025: Expansion into derivatives, ETFs, and RWAs (real estate, commodities).

The DevvE Token: Fueling the Future of Finance

DEVVE, the native token of DevvX™, is central to the exchange’s ecosystem:

- Liquidity Mining: Earn DEVVE by providing liquidity to trading pairs.

- Governance: Vote on platform upgrades and asset listings.

- Fee Discounts: Reduced trading fees for DEVVE holders.

With a fixed supply and deflationary burn mechanism, DEVVE is designed to appreciate as DevvExchange™ scales.

A New Standard for Digital Asset Exchanges

DevvExchange™ isn’t just competing with Coinbase or Binance—it’s reimagining the infrastructure of global finance. By merging blockchain’s efficiency with TradFi’s rigor, it offers:

- Risk Mitigation: No more “hot wallet” hacks or insolvency exposures.

- Cost Efficiency: Near-zero fees via decentralized order matching.

- Regulatory Peace of Mind: Built-in compliance for 150+ jurisdictions.

Forward-Looking Statements

This press release includes projections about DevvExchange™’s capabilities and market impact. These statements involve risks, such as regulatory changes, technological hurdles, and market adoption challenges. DevvDigital™ disclaims any obligation to update forward-looking statements unless required by law.

Source: DevvDigital Partners with Global Financial Institution