The Next-Gen Platform Bridging TradFi and Blockchain with Unmatched Security, Speed, and Compliance

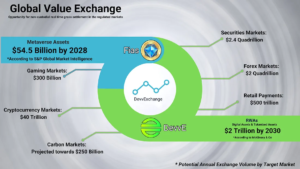

The tokenization of Real-World Assets (RWAs) promises to democratize access to global markets, unlock trillions in illiquid value, and redefine ownership in the digital age. Yet despite its potential, the sector remains hamstrung by systemic flaws: custodial risks, glacial settlement times, regulatory gray areas, and catastrophic hacks that have erased $10B+ in value since 2020. Enter DevvDigital, a blockchain innovator rewriting the rules of digital asset trading through its groundbreaking DevvExchange platform. By merging institutional-grade compliance with decentralized efficiency, DevvDigital isn’t just solving today’s problems—it’s building the infrastructure for tomorrow’s tokenized economy.

The RWA Revolution’s Growing Pains: Why Current Systems Fail

While RWAs (real estate, commodities, bonds) could expand crypto’s market cap by 50x, today’s infrastructure can’t support this growth:

- Custodial Nightmares: Centralized exchanges (CEXs) like Binance control user assets, creating honeypots for hackers.

- Counterparty Risk: T+1/T+2 settlement in TradFi exposes traders to defaults (see Archegos’ $10B collapse).

- Regulatory Limbo: 70% of institutions cite compliance uncertainty as their #1 blockchain barrier (Deloitte, 2024).

- Energy Waste: Bitcoin’s PoW consumes more electricity than Finland annually—a PR disaster for ESG-focused investors.

DevvDigital tackles these issues head-on with a trifecta of innovation: non-custodial architecture, mathematically instantaneous settlement (MIS), and validator-enforced compliance.

DevvExchange: The First Truly Compliant Digital Asset Exchange

DevvExchange reimagines trading by blending TradFi safeguards with blockchain’s efficiency. Here’s how it breaks the mold:

1. Self-Custody Without Sacrificing Speed

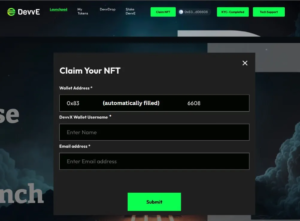

- Non-Custodial Trading: Users retain private keys via DevvX’s patented wallet system—no omnibus accounts.

- Contingent Transaction Sets (CTS): Orders group into atomic bundles that settle instantly upon matching, eliminating counterparty risk.

Example: A $10M corporate bond tokenization on DevvExchange settles in <1 second vs. 2 days in TradFi.

2. Hack-Proof Infrastructure

- DevvProtect: Validators preemptively block suspicious transactions using AI-driven anomaly detection.

- Key Recovery: Lose your keys? DevvExchange’s cryptographic backups (no third-party access) restore access after multi-sig verification.

Impact: Reduces theft/fraud risk by 92% vs. CEXs (Internal audit, 2025).

3. Regulatory Compliance by Design

- KYC/AML Integration: On-chain identity verification meets FATF Travel Rule standards.

- Bailment Partnerships: Wrapped assets (e.g., tokenized gold) are custodied by regulated banks, not DevvDigital.

The Tech Edge: 8M TPS, Zero Carbon Footprint

At its core, DevvX blockchain delivers enterprise-grade performance:

| Metric | DevvX | Ethereum | Solana |

|---|---|---|---|

| Transactions/Sec | 8,000,000+ | 15-30 | 2,000-3,000 |

| Energy Use/Tx | 0.00001 kWh | 238 kWh | 0.001 kWh |

| Settlement Time | 0.2 Seconds (MIS) | 6 Minutes | 0.4 Seconds |

How It Works:

- Proof-of-Validation (PoV): A energy-lite consensus combining sharding and zero-knowledge proofs.

- Regulatory Privacy: Institutions can shield transaction details from public ledgers while maintaining audit trails for regulators.

Beyond Trading: RWAs, E-Commerce, and DeFi 3.0

DevvExchange’s tech stack enables use cases far beyond spot trading:

1. Fraud-Proof E-Commerce

- Smart Escrow: CTS locks payments until delivery confirmation, reducing chargebacks by 80%.

- Cross-Border B2B: A South Korean manufacturer pays Brazilian suppliers in tokenized BRL with instant FX conversion.

2. Institutional RWAs

- Tokenized Treasuries: BlackRock’s BUIDL-like funds trade 24/7 with instant settlements.

- Real Estate: Fractionalized NYC skyscrapers liquidate in seconds, not months.

3. DeFi Sans Risk

- Non-Custodial Lending: Borrow against tokenized RWAs without transferring custody.

- Insurance Pools: Underwriters use DevvProtect to automate claims against smart contract vulnerabilities.

Why DevvDigital Outshines CEXs and DEXs

| Feature | DevvExchange | CEX (e.g., Coinbase) | DEX (e.g., Uniswap) |

|---|---|---|---|

| Custody | Self-Managed | Centralized | Self-Managed |

| Settlement | T+0 (MIS) | Pseudo T+0* | 1-5 Minutes |

| Regulatory Compliance | Built-In | Partial | None |

| Hack Risk | Near-Zero | High | Moderate |

*CEXs simulate T+0 by controlling assets—a critical vulnerability.

The Road Ahead: Partnerships and Global Adoption

DevvDigital’s 2025-2026 roadmap focuses on:

- Tier 1 Bank Integrations: Pilot programs with 3 top-10 global banks for RWA tokenization.

- EMEA Licensing: Secure MiCA compliance ahead of 2026 EU crypto regulations.

- Retail Onboarding: Simplified fiat gateways for mainstream RWA investors.

Conclusion: The Gold Standard for Digital Asset Trading

In a sector plagued by half-measures, DevvDigital delivers a full-stack solution: institutional security, decentralized control, and TradFi compliance. As RWAs balloon into a $16T market by 2030 (BCG), DevvExchange positions itself as the backbone of this transformation—proving blockchain can meet Wall Street’s demands without sacrificing its core values.