London, England – January 29, 2025 – DevvDigital™, the pioneering force behind the institutional-grade digital asset exchange DevvExchange™, today announced the appointment of Will Stewart to its Board of Directors. With over three decades of experience in global finance, venture capital, and disruptive technology, Stewart will spearhead capital strategy, corporate development, and partnerships to accelerate the adoption of DevvExchange’s non-custodial, instant-settlement trading infrastructure.

Strategic Leadership: Will Stewart’s Track Record

A Silicon Valley luminary, Stewart has orchestrated billions in capital raises and exits across 200+ venture-backed tech firms. His recent focus on digital marketplaces, environmental commodities, and energy transition infrastructure aligns seamlessly with DevvDigital’s mission to bridge TradFi and blockchain innovation.

Key Achievements:

- Capital Markets Mastery: Structured $500M+ funding rounds for fintech and blockchain startups.

- Regulatory Advocacy: Advised U.S. and EU policymakers on digital asset frameworks.

- Tokenization Expertise: Led tokenized carbon credit initiatives driving $2B+ in liquidity.

Stewart’s appointment arrives as DevvExchange prepares to capitalize on two seismic shifts:

- U.S. Regulatory Tailwinds: President Trump’s recent executive order, “Strengthening American Leadership in Digital Financial Technology,” positions blockchain as a pillar of national economic strategy.

- Tokenization Boom: Bain & Co. projects private market assets will surge to $65 trillion by 2032, with tokenization unlocking liquidity in alternatives like real estate and venture capital.

Why Stewart’s Role is a Game-Changer

As DevvExchange scales, Stewart’s mandate includes:

1. Institutional Partnerships

- Forge alliances with Tier 1 banks, asset managers, and sovereign wealth funds to onboard tokenized RWAs (Real-World Assets).

- Expand DevvExchange’s presence in ESG-driven markets, leveraging Stewart’s climate tech network.

2. Capital Strategy

- Secure strategic funding to enhance liquidity pools for DevvE (DEVVE), the native token powering DevvX blockchain transactions.

- Drive M&A opportunities to integrate complementary fintech solutions.

3. Regulatory Advocacy

- Collaborate with global regulators to shape compliant digital asset frameworks, building on DevvExchange’s built-in KYC/AML protocols.

Ray Quintana, CEO of DevvDigital, emphasized:

“Will’s acumen in scaling tech ecosystems is unmatched. His leadership will fast-track DevvExchange’s vision to redefine value exchange—combining TradFi’s rigor with blockchain’s efficiency.”

DevvExchange: The Institutional Gateway to Tokenized Assets

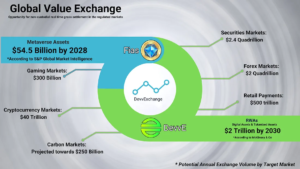

Amid a $16 trillion tokenization market (McKinsey, 2025), DevvExchange’s unique value proposition includes:

1. Non-Custodial Architecture

- Users retain full asset control via private keys, eliminating custodial risks exposed by FTX’s collapse.

- Contingent Transaction Sets (CTS): Atomic settlement ensures trades finalize instantly or not at all, removing counterparty risk.

2. Regulatory Compliance

- FATF Travel Rule Integration: Automated transaction monitoring meets global AML standards.

- Institutional Bailment: Partnered banks custody wrapped assets (e.g., tokenized gold), shielding users from platform insolvency.

3. Unmatched Throughput

- The DevvX blockchain processes 8M+ transactions/second at near-zero cost, dwarfing Ethereum’s 30 TPS and Solana’s 3,000 TPS.

Market Momentum: Policy Shifts and Private Capital Inflows

Stewart’s arrival coincides with pivotal developments:

1. U.S. Policy Revolution

President Trump’s executive order mandates federal agencies to:

- Recognize digital assets as “legitimate financial instruments.”

- Develop a unified regulatory framework by Q3 2025.

- Position the U.S. as the global hub for blockchain innovation.

Tom Anderson, Devvio Co-Founder, noted:

“This policy shift validates DevvExchange’s core tech—non-custodial trading, instant settlement, and institutional compliance. We’re primed to lead America’s digital finance era.”

2. The $65 Trillion Private Market Opportunity

Bain & Co.’s 2024 report highlights 12% CAGR growth in private markets, driven by:

- Pension funds and insurers seeking higher yields amid public market volatility.

- Tokenization’s ability to fractionalize illiquid assets (e.g., infrastructure, private equity).

Stewart’s Vision:

“DevvExchange will be the nexus where private assets meet blockchain liquidity. Imagine trading tokenized vineyards or VC stakes as easily as stocks—this is the future we’re building.”

2025 Roadmap: Product Launches and DevvE Utility Boost

Post-Stewart’s appointment, DevvDigital plans:

1. Q2 2025: Tokenized RWAs

- Launch real estate, private equity, and carbon credit pools on DevvExchange.

- Partner with BlackRock-esque firms to tokenize institutional-grade assets.

2. Q3 2025: DevvE Staking

- Introduce yield-generating staking for DEVVE holders, with APYs tied to exchange volume.

- Burn mechanisms to reduce DEVVE supply, enhancing scarcity.

3. Q4 2025: Derivatives Marketplace

- Roll out futures and options for crypto, commodities, and forex.

- Integrate AI-driven risk management tools for institutional traders.

Conclusion: Redefining Global Finance

With Will Stewart’s leadership, DevvExchange is poised to capture the convergence of TradFi credibility and blockchain disruption. As tokenization eats the world, DevvDigital’s blend of speed, security, and compliance positions it as the exchange of choice for institutions and retail alike.

Connect with Will Stewart: LinkedIn

Explore DevvExchange: www.devv.exchange