DevvDigital Partners with Devvio to Launch DevvExchange: Redefining Secure, Instant Digital Asset Trading

Exclusive License Agreement Powers First Non-Custodial Exchange with Mathematically Instantaneous Settlement

DevvDigital Inc. has secured an exclusive global license from blockchain pioneer Devvio Inc. to operate DevvExchange, a revolutionary digital asset trading platform that eliminates middlemen, custodial risks, and settlement delays. By leveraging Devvio’s patented Contingent Transaction Set (CTS) technology and the DevvX blockchain, DevvExchange promises to transform how institutions and retail traders interact with cryptocurrencies, tokenized assets, and RWAs (Real-World Assets).

The Breakthrough: Contingent Transaction Sets (CTS) Explained

At the core of DevvExchange lies CTS technology, a patent-pending innovation that redefines transactional integrity and speed. Here’s how it works:

- Atomic Transaction Groups: CTS bundles multiple trades into a single set, validated simultaneously by DevvX validators.

- All-or-Nothing Execution: Transactions only finalize if all conditions within the set are met, eliminating partial settlements.

- Mathematically Instantaneous Settlement: Trades settle in milliseconds (T+0), removing counterparty risk and custodial dependencies.

Example: A user swapping BTC for ETH and a separate ETH-to-USDT trade are grouped into one CTS. Both execute simultaneously—no waiting, no slippage.

Why DevvExchange Outperforms Traditional Platforms

DevvExchange addresses critical flaws plaguing both centralized (CEX) and decentralized exchanges (DEX):

| Feature | DevvExchange | CEX (e.g., Binance) | DEX (e.g., Uniswap) |

|---|---|---|---|

| Custody | Non-Custodial | Centralized | Non-Custodial |

| Settlement Time | T+0 (Instant) | Pseudo T+0* | 1-5 Minutes |

| Regulatory Compliance | Built-In | Variable | Limited |

| Hack Risk | Near-Zero | High | Moderate |

| Energy Efficiency | 1Bx Better Than Bitcoin | High | Moderate |

*CEXs simulate T+0 by controlling user assets—a critical vulnerability exposed by FTX’s collapse.

Key Features Driving Institutional Adoption

1. Non-Custodial Architecture

- User-Controlled Assets: Private keys remain in users’ hands via DevvX’s secure wallets.

- No Omnibus Accounts: Removes “hot wallet” honeypots targeted by hackers.

2. Regulatory-First Design

- KYC/AML Integration: On-chain identity checks align with FATF Travel Rule standards.

- Audit Trails: Institutions can privately log transactions for compliance without exposing public ledger details.

3. Infinite Scalability

- 8M+ TPS: The DevvX blockchain handles institutional-grade volume without congestion.

- RESTful API: Simplifies integration for brokers, hedge funds, and fintech apps.

Tom Anderson on the Future of Exchanges

Tom Anderson, CEO of Devvio Inc., underscores the transformative potential:

“Global asset exchanges will adopt mathematically instantaneous settlements. If two parties can trade directly, sans middlemen or risk, it’s a quantum leap over TradFi and crypto platforms. DevvExchange isn’t just innovative—it’s the new gold standard.”

The DevvX Blockchain: Engine of Efficiency

DevvExchange’s backbone, the DevvX blockchain, offers unrivaled performance:

- Energy Efficiency: 1 billion times greener than Bitcoin’s Proof-of-Work.

- Validator Security: Decentralized nodes preempt fraud via AI-driven anomaly detection.

- Cost-Effective: Near-zero fees for high-frequency traders.

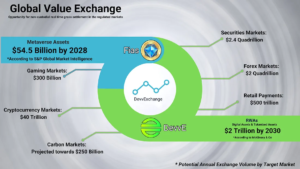

Use Cases: From RWAs to Retail Trading

DevvExchange’s versatility spans markets:

1. Tokenized Real-World Assets (RWAs)

- Instant Property Sales: Fractionalized real estate trades settle in seconds.

- Corporate Bonds: Institutions trade tokenized debt 24/7 with T+0 finality.

2. Retail-Friendly Trading

- Self-Custody for All: Retail users bypass CEX risks while enjoying CEX-like speed.

- Cross-Chain Swaps: CTS enables seamless BTC-to-ETH-to-SOL trades in one click.

3. DeFi Innovations

- Non-Custodial Lending: Borrow against crypto without transferring ownership.

- Insurance Pools: Smart contracts automate claims against hacks or bugs.

Strategic Impact of the Devvio-DevvDigital Partnership

This exclusive license positions DevvDigital at the forefront of compliant, scalable blockchain solutions:

- Global Reach: Operate in regulated markets (EU, US, Asia) with localized compliance.

- Enterprise Adoption: Pilot programs with Tier 1 banks for RWA tokenization.

- Market Differentiation: First exchange combining T+0, non-custodial control, and infinite scalability.

Roadmap: What’s Next for DevvExchange?

- Q4 2024: Beta launch with select institutional partners.

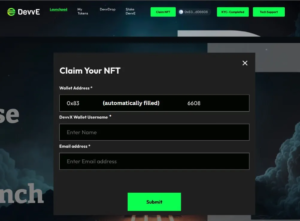

- Q1 2025: Public rollout featuring BTC, ETH, and DevvE (native token) pairs.

- 2026: Expand into derivatives, ETFs, and metaverse asset trading.

About Devvio Inc. & DevvDigital

Devvio Inc.: A blockchain pioneer renowned for DevvX—a sustainable, scalable infrastructure trusted by enterprises.

DevvDigital: The exclusive operator of DevvExchange, focused on user empowerment and regulatory innovation.

Forward-Looking Statements

This press release includes projections subject to risks like regulatory shifts and market volatility. DevvDigital disclaims any obligation to update statements post-publication.